The share of mobile traffic was expected to only keep growing ever since Google started talking about mobile-first indexing.

Yet the pandemic disrupted this trend, and we kept tying the decline of mobile to COVID-induced measures. Meaning that once the measures are lifted, we’ll see a full comeback of mobile.

But it looks like the new normal isn’t just about stricter air travel and more people working from home. So far, mobile traffic doesn’t look like it’s on the way to a full return—so the question remains: is desktop really coming back? Or will mobile traffic eventually make a comeback?

These questions are the focus of our latest State of Mobile report. We looked at the mobile web and app landscape to analyze year-over-year mobile penetration trends and pinpoint a few turning points that will shape the mobile landscape in years to come.

About the State of Mobile Report

Using our own Semrush .Trends and Open .Trends intel, we managed to analyze the entire surface of the mobile web:

- Global mobile traffic patterns over the years

- Key channels that bring in mobile traffic across various industries

- Granular analysis of different industries—from the key traffic generation strategies to an in-depth exploration of their advertising tactics.

For the advertising bit, we leveraged data coming from AdClarity—an app you can find in our Semrush App Center.

We also employed another App Center tool called Mobile App Insights to explore the mobile app landscape and assess some of the key downloads trends for the past few years.

Altogether, these insights helped us understand the growth dynamics across the mobile web and app territory to predict whether mobile will have a comeback, or if we should stop using the “pandemic excuse” to predict future mobile patterns.

The State of Mobile Report: Top Highlights

Below, we’ll reveal the key discoveries from our report to give you a sneak peek into the current state of mobile.

1. Mobile web is still losing its share

The second half of 2021 has been marked by lowering COVID restrictions—people were gradually returning to the offices, air travel saw some recovery signs, etc.

But this had little to no impact on mobile traffic.

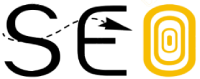

In March 2022 we see 30% fewer mobile surfers than in May 2021—and the difference between strict measures is drastic between the two dates.

2. Strict COVID measures don’t have a close relationship with mobile traffic

The data above suggests there is no direct correlation between the extent of mobile penetration and the growth of desktop vs. the pandemic-related restrictions.

But we found more proof.

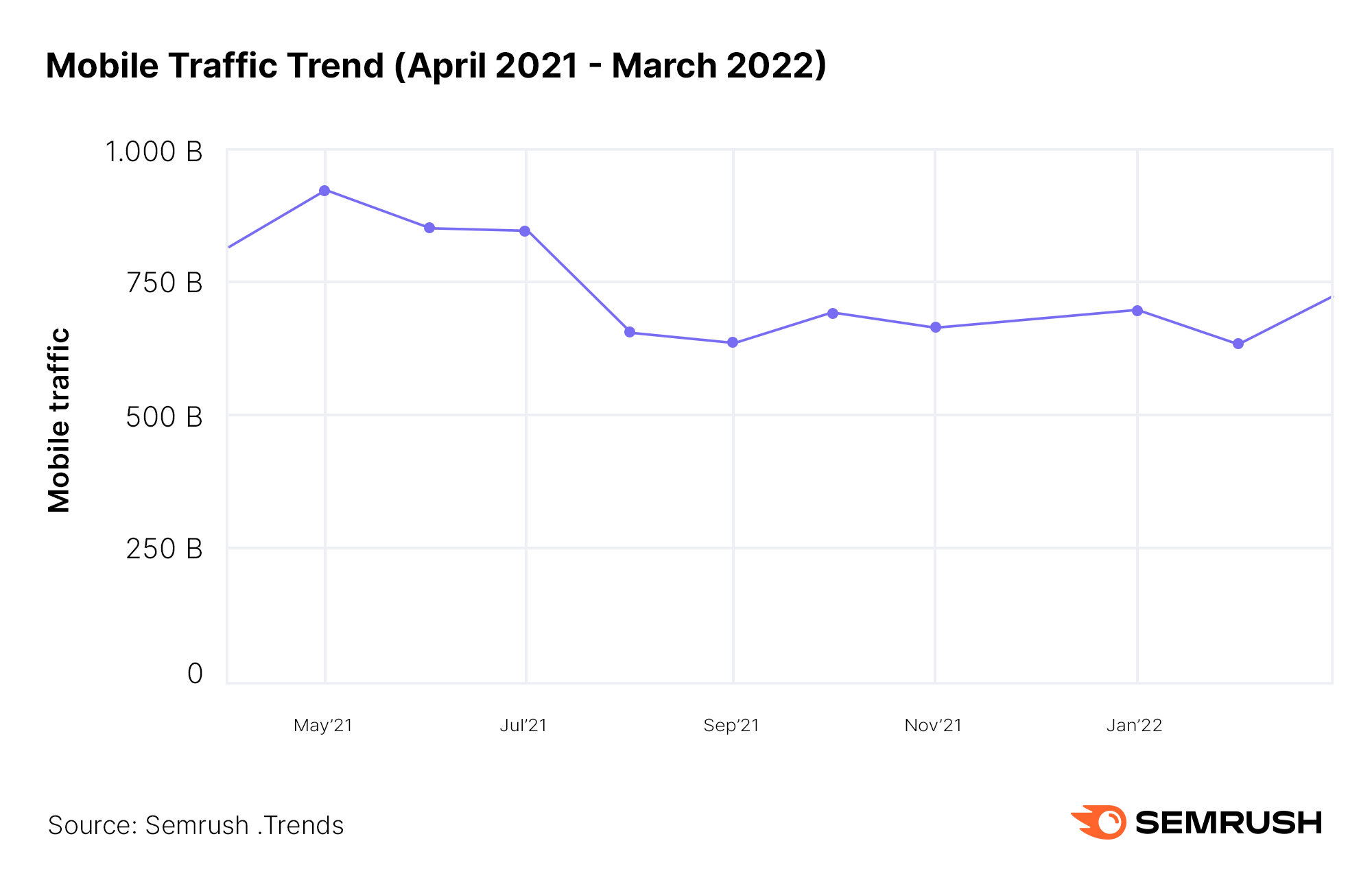

When we compared mobile and desktop traffic shares, we spotted no link between mobile traffic and, let’s say, strict lockdowns.

As you can see, in Australia and Canada, countries with the longest-standing COVID measures, mobile traffic share is much higher than in the US where we saw a softer take on lockdowns.

This implies that our previously taken-for-granted notion that “people turned to desktop as they were forced to stay at home” doesn’t sound exactly right. And our findings only proved this.

3. The drop in mobile seemingly affected the app landscape as well

No report assessing the state of mobile would be complete without an exploration of how things are going on the Apple Store and Google Play’s side.

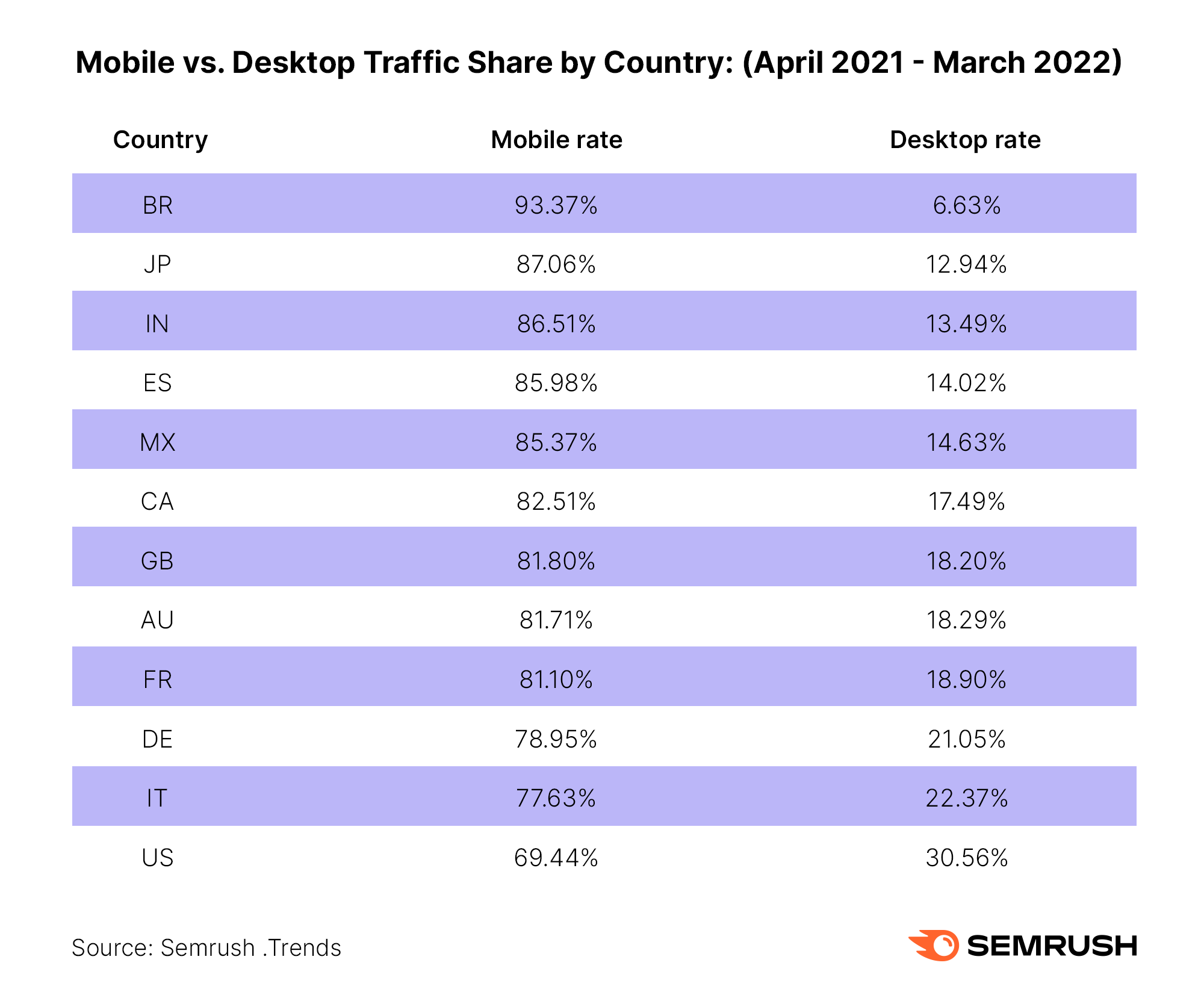

As you can see, the three-year downloads data reflects a downward trend across iOS. Some of the most popular app categories—Games and Shopping—saw 20% fewer downloads in April 2021-March 2022 vs. April 2020-March 2021.

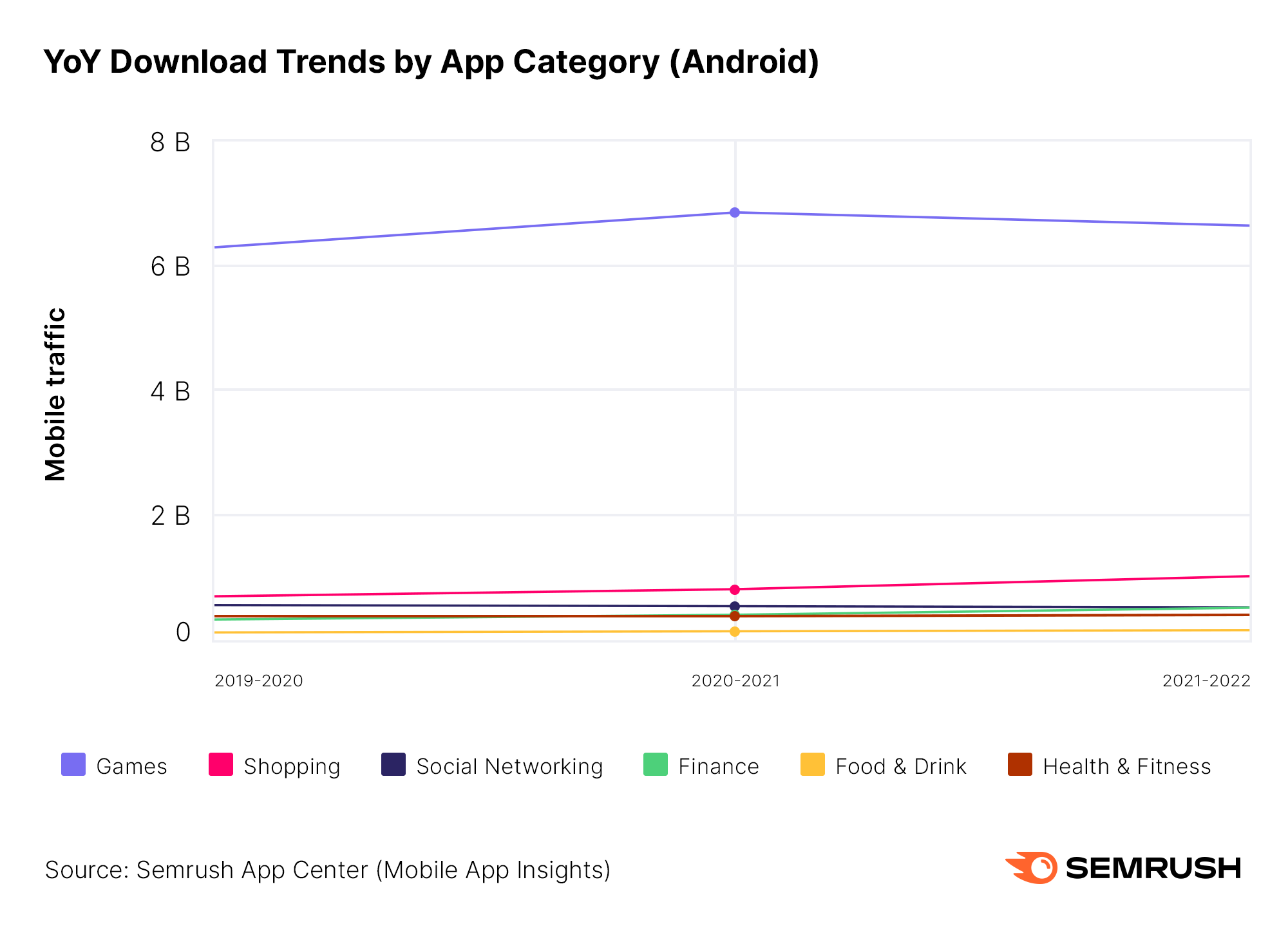

On the Android side, things look more promising as almost every app category but Games witnessed a YoY rise in installs.

4. Direct still plays a major role in bringing in mobile traffic

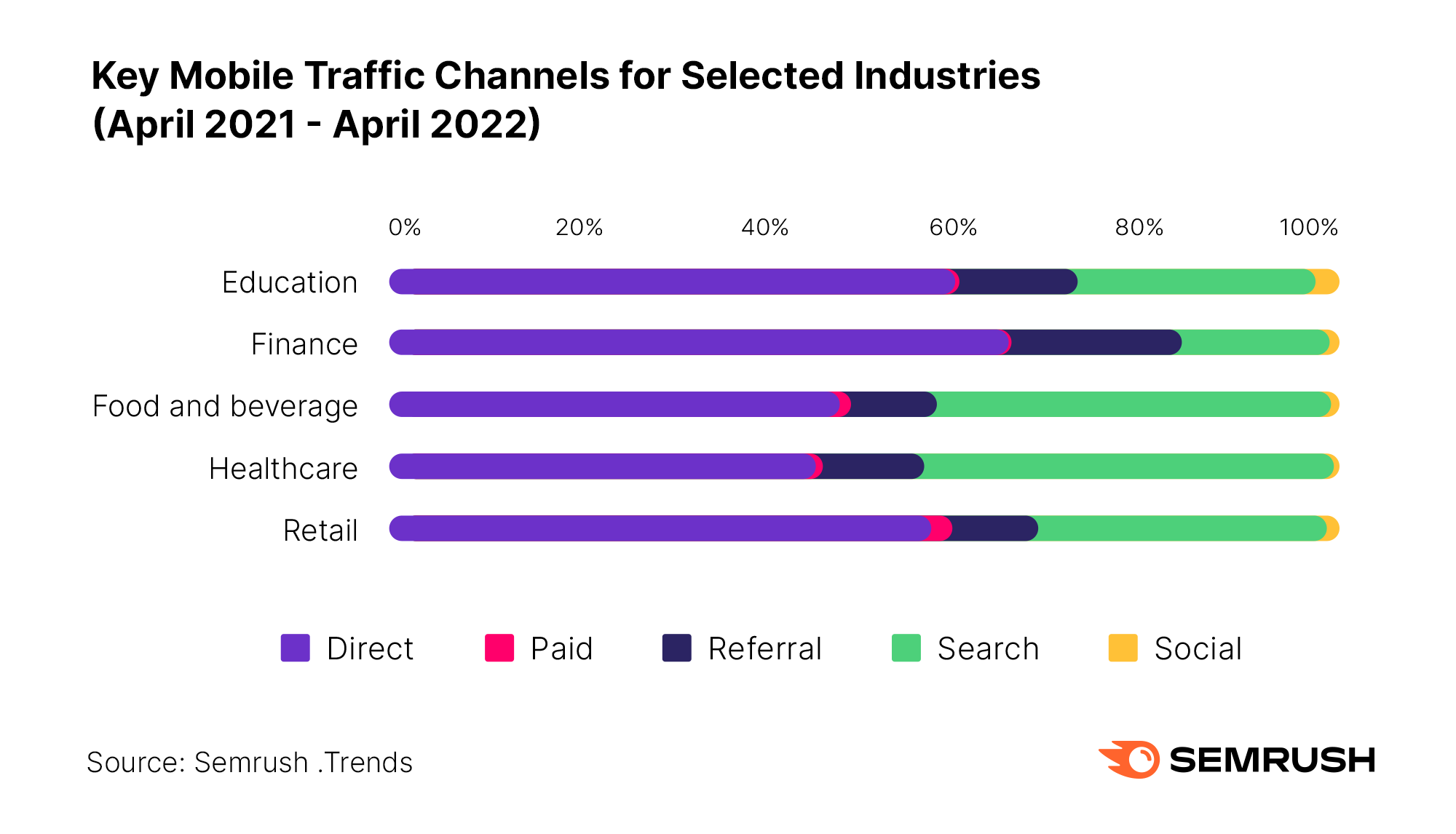

Regardless of the industry or the year, direct traffic was the number one traffic source when it came to generating mobile traffic.

This means that brand awareness campaigns, as well as smart customer loyalty and satisfaction programs, can go a long way if you want to up your mobile traffic share.

In some instances, however—just look at the Healthcare or Food & Beverage sectors—search played a comparable role in their traffic generation strategies, so you cannot disregard SEO.

5. Pay attention to the Finance industry’s video advertising strategies

As we took a thorough look at the industry-by-industry advertising strategies, one sector stood out in regard to its performance trend.

If we typically see a close tie between ad budgets and performance, the Finance sector seemingly found a secret sauce for their video ad strategy.

Finance was the only market segment that managed to decrease its ad dollar counts while also growing the number of impressions. So it’s worth taking a closer look at what they did to break the usual budget-performance tie.

6. Despite the big hit, mobile still dominates the digital sphere

If the pre-pandemic era was about mobile-first approaches and expectations about the decline of desktop, we’re now seeing a different trend.

But it doesn’t mean ‘mobile is dead’—we’re still seeing mobile traffic dominate across the board.

What does this mean for those who want to win the digital game? Omni-channel is the answer. This implies that you have to offer an impeccable user experience for whatever device your audience is using.

Explore the Full State of Mobile Report and Futureproof Your Digital Strategy

These highlights are only scratching the surface of all the insights we managed to unwrap throughout our report.

If you want to see a more granular look at each industry, their advertising strategies for mobile, and even Apple Search Ads patterns, explore the full report.

What else is in there?

- You’ll find out the biggest advertisers and publishers attracting the highest mobile traffic shares for each analyzed industry

- You’ll unwrap the most trending apps of this year

- You’ll discover the average cost per install across app categories and reveal the downloads trend from Apple Search Ads